Written by Tony Kaye

WHEN online insurance broker iSelect joins the ranks of Australia’s listed companies on Monday, as expected, it will mark an important milestone in the corporate recovery process.

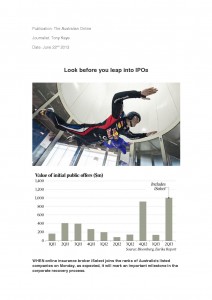

Its initiation into public life – through a $215 million initial public offering – will take the tally of local stockmarket floats for the June quarter to above $1 billion, the best quarter in 2 1/2 years.

The level is still is a far cry from the boom days, pre-global financial crisis, but there are more signs of corporate and investor confidence as more companies venture back to the public boards.

Investor demand for new floats is strengthening, and there’s often good money to be made in the process. A number of the larger floats this year have already delivered strong returns, with their share prices well up since their market debut.

Take fertility service company Virtus Health (VRT), which has gained about 14 per cent since listing this month, while the high-profile law firm Shine Corporate (SHJ) has jumped about 46 per cent. Property trust Arena REIT (ARF) and data facilities owner Asia Pacific Data Centre Group (AJD) have produced returns of 4.5 per cent and 12 per cent respectively.

But the best performing listing this year has its investors jumping for joy. Indoor Skydiving Australia Group (IDZ), a skydiving facilities developer, has more than doubled in value in just five months from its 20c offer price.

Equally, however, there are multiple examples of new listings where investors are significantly out of the money on their initial investment.

IPB Petroleum, for example, offered investors shares at 50c each.

Since listing in late April, its shares have plunged to 25c. Zeus Resources has been the worst float performer to date, issuing its shares at 20c apiece.

Since listing in January, its shares are now trading below 4c.

For investors considering a subscription to a new float, thorough research isessential. And there is even historical evidence that shows the best returns from initial public offerings are often achieved by getting out on the first day. An investor who participated in all 15 IPOs this calendar year, and sold them at the end of the first day of trade, would have made an average return of 2.7 per cent.

Using the same strategy on the last 300 IPOs over the past five years, an investor would have made a 10 per cent average return.

Data also shows new stocks can quickly lose momentum after their market entrance. Only about a third of new stocks actually outperform the ASX All Ordinaries Index in the first six months of their listing.

Eureka Report’s small caps specialist Brendon Lau notes that there are many reasons why a new stock can struggle over the short to medium-term.

“If I had to make a general observation, I would say that new entrants are usually at a disadvantage compared with their more established rivals, which tend to be larger and better understood by the investment community. Only when, and if, the newbie develops a sustained track record will the discount gap close.

“Picking the right IPOs will yield you an average total return that is 52 per cent ahead of the market at the 180-day mark, while the laggards underperform by an average of 33 per cent.”

According to Bell Potter Securities’ head of research, Peter Quinton, in this market environment newly listed companies with reasonably defensive and predictable earnings are “in”, while speculative cyclical stocks are “out”.

“If (the new listing) is from one of those defensive sectors where it has got some protection from slowing economic growth, I think automatically people will look at it very closely,” Mr Quinton said.

“But as a start, IPOs need to be priced at a discount to their peer group; and all things being equal, my rough (estimate) is that the price-earnings will need to be 10 per cent lower and the yield 10 per cent higher (than their peers).”

But valuations are last on Mr Quinton’s checklist as qualitative analysis is more important. The things he looks for first are:

if the vendor is keeping any shares (company founders retaining shares is seen as a positive);

The composition of the shareholdings;

The outlook for the sector over the next two to three years; and

If the company forecasts outlined in the prospectus look reasonable.

He also tends to avoid IPOs where the company has bought a couple of other businesses to appear bigger, as this strategy has produced more failures than successes.

The ASX is listing 12 upcoming floats, including ISelect.

Of those, only four have a set listing time.

The remainder are to be advised, including the $100m float of Domus US Multifamily Real Estate Fund, which was due to list earlier this week but suddenly put its marketebut on hold – perhaps a reaction to the rapidly falling Australian dollar and the impact on its US property purchasing power. There’s no doubt the market remains volatile, and IPOs are still few and far between.

Good returns from small-cap IPOs are also few and far between.

So subscribers to iSelect will no doubt be hoping they’ve ticked all the right boxes when the company lists on Monday.