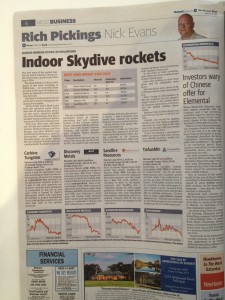

Written by Nick Evans

The dire state of the capital markets for junior miners is clearly evident if you take a quick scan of this year’s IPOs.

The class of 2013 is, so far, a touch ahead of last year, according to IRESS data – 12 successful floats got away at the close of trading yesterday, as opposed to 10 at the same time last year.

But what’s striking about the list is how few resource companies are among that number.

All 10 of last year’s floats came from the resources sector. There were two oil and gas plays, including last year’s stand-out market star Pura Vida Energy with the remainder being traditional exploration juniors from the mining sector.

This year there have only been six. Oil and gas hopefuls Cott Oil and Gas, Strata-X Energy and Tiou Energy; coal plays Malabar Coal and Perpetual Resources; and Chinese-backed uranium explorer Zeus Resources. At a pinch, labour hire firm Oilfield Workforce Group could probably be added to that list.

The list is rounded out with two investment funds, an outdoor advertising and tech company focusing on the Chinese market (China Integrated Media Corporation), clean tech hopeful Ecosave Holdings, and novelty extreme sport company Indoor Skydive Australia Group.

Compare those figures to the situation two years ago. By this time in 2011, the market had welcomed 33 new floats, with 25 in the resources sector – and it becomes even clearer how complete the exodus from the resources sector has been.

Of the current crop, Indoor Skydive is the stand-out. Although it trades on very thin volumes, the company is up 85 per cent from its 20¢ January float, closing yesterday at 37¢. Ecosave, which also experiences light trading volumes, has been the other big winner, up 69 per cent to ¢1.69 from its $1 January issue price.

At the close of trade yesterday, none of the rest were trading ahead of their listing price. Four were trading at their float price, and the remainder were down.

Zeus has fallen most, down 13.9¢ or 69.5 per cent to close yesterday at 6.1¢. Since listening in mid-January at 20¢, the company has not issued a single release to the market about its uranium exploration activities, and has drifted steadily downwards.

Malabar Coal is down 28 per cent and Cott Oil and Gas is off 22.5 per cent. Overall you would be slightly ahead if you had taken a speculative punt on every float so far this year, even though half your investment would be down.

If you had thrown a speculative $5000 into each of this year’s floats, your $60,000 portfolio would currently be worth $60,885.