Value of funds raised set to jump from $1.3b to $7.8b

19 December 2013: After five years in the doldrums, the initial public offering (IPO) market has bounced back in the second half of 2013, with the value of funds raised in the calendar year to soar from $1.3 billion to $7.8 billion.

The latest Deloitte Corporate Finance IPO review finds that, by the end of calendar year 2013, an expected 61 IPOs will be finalised, up from 48 in 2012.

This will make 2013 the biggest year for float activity since the GFC (2007) in terms of funds raised, when 260 IPOs delivered a combined capital raising of more than $10 billion.

Deloitte Corporate Finance Partner and IPO specialist Ian Turner said: “The year has been one of two halves, with the steady growth in the ASX, growing confidence and strong demand from institutional investors, combined with the success of some of the earlier floats such as Virtus, paving the way for a rush of new listings in the second half.

“Approximately 90 per cent of total funds raised in the year are expected to be raised in the second half of 2013, with December alone expected to produce 23 IPOs with a combined capital raising of $4.6 billion.”

Annual funds raised by IPO 2000-2013

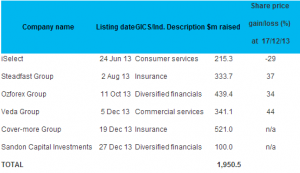

A growing trend in 2013 has been the supply of floats from private equity, with about 25 per cent or $2.1 billion of total funds raised being from private equity exits.

Largest IPOs by private equity funds

Deloitte Corporate Finance Partner Steve Woosnam said: “Contrary to at times negative sentiment around pricing of private equity exits, the year-to-date price performance from private equity-owned companies has shown some very positive returns, most notably, Virtus Health, Veda Group and Ozforex who have all achieved 30-plus per cent price gains.”

“While some recent floats are currently in negative territory, we still expect the IPO window to remain open into the New Year, fuelled by a backlog of companies whose listing options in previous years have been limited and given strong and ongoing institutional and retail investor demand.

“The hot sectors in 2013 were financial services, property and healthcare, and they will continue to provide plenty of floats in 2014. We also expect to see plenty of continued supply from private equity.”

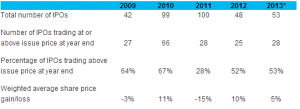

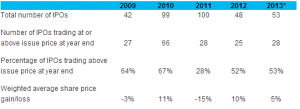

The percentage of IPOs trading at or above their issue price was steady with the previous year at 53 per cent, but much improved from a low of 29 per cent in 2011. In addition, the total weighted average price gain of all floats was an encouraging five per cent.

Summary of IPO share price performances

*53 of expected 61 IPOs listed at preliminary review date of 17 December 2013

Indoor Skydive Australia was the best performing IPO of the year, with the Sydney-based company’s 20 cent shares improving by 175% to 55 cents at the review date of 17 December 2013.

The next-best performers were Freelancer (up 156 per cent), Brisbane-based phosphate explorer Fertoz (up 130%) and legal firm Shine Corporate (up 78 per cent).

Mr Turner said the ten largest and the ten best performing IPOs of the year spanned a wide range of industry sectors, reflecting the broad-based nature of the rebound in the IPO market.

“In particular, significant interest has been generated in real estate, financial sevices and healthcare, however the withdrawel of some potential IPO candidates this year also highlights that there is not universal support across all sectors,” he said.

Top 10 IPOs by share price performance

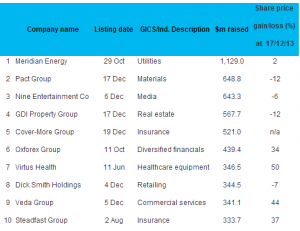

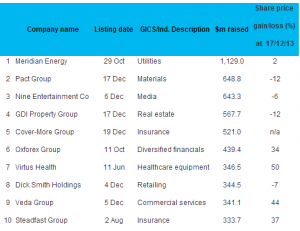

The largest IPO for the year was New Zealand-based Meridian Energy, which listed on the NZX and the ASX after an initial public offer to investors on both sides of the Tasman totalling A$1,129 million. The total amount raised will increase to A$1,694 million when a second instalment falls due in February 2015.

Four of the five largest IPOs of the year are scheduled to occur in December with Cover-More Group ($521.0 million) expected to list this week, following the recent listing of Pact Group ($648.8 million), GDI Property Group ($567.7 million) and Nine Entertainment Co. ($643.3 million) which listed earlier this month.

Top 10 IPOs by size

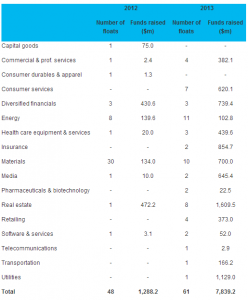

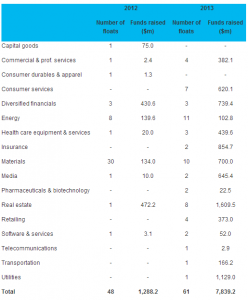

Mr Woosnam said the industry profile of IPO activity had changed markedly in 2013.

“Resource IPOs out of Perth have dominated the market in terms of number of floats since the GFC,” he said.

“This trend continued into 2012, when almost 80 per cent of all floats were in the mining or energy sectors.

“In 2013, resource floats dropped to only one-third of all IPO activity, and we have seen the re-emergence of industries such as real estate, financial services, healthcare and consumer services.”

IPOs by industry sector

Analysis of float activity by business type (rather than GICS industry classification) highlights the importance of the financial services, real estate and healthcare sectors in the rebound in the IPO market in 2013.

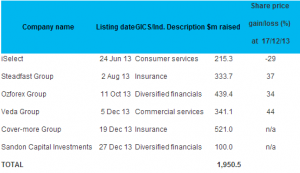

Financial services IPOs > $10m

Financial services related IPOs accounted for $2 billion, or 25 per cent, of all funds raised. The sector produced a number of strong share price performances, resulting in a weighted average price gain of 27 per cent as of the review date.

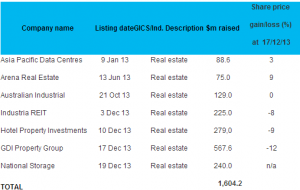

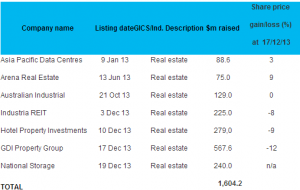

Real estate IPOs > $10m

Real estate IPOs were also a large source of float activity, accounting for $1.6 billion or 20 per cent of all funds raised, although average price performance was in negative territory at a weighted average share price loss of seven per cent as of the review date, with one more IPO in the sector to follow in the last week before Christmas.

Healthcare/Pharmaceutical IPOs

Healthcare-related IPOs were also an emerging trend in the 2013 market, with a total of $462 million raised by five floats. The weighted average share price gain was 38 per cent, thanks largely to the 50 per cent gain by Virtus Health, one of the 10 largest IPOs of the year.

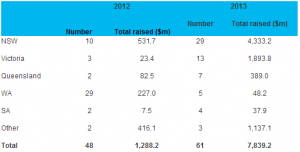

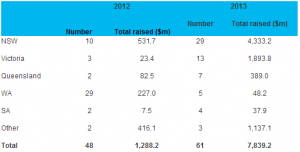

IPO activity by state

NSW was the most active state for IPOs in terms of float numbers and value of capital raised. The state produced almost half of all IPOs for the year (29 out of 61), and accounted for more than half of the total amount raised. Significant IPOs that have listed to date from NSW include Nine Entertainment Co. ($643m), GDI Property Group ($568m), Cover-More Group ($521m), Virtus Health ($347m), Veda Group ($341m), Ozforex Group ($439m) and Dick Smith Holdings ($345m).

Victoria ranked second among the states, due to large IPOs such as Pact Group ($648.8 million), Hotel Property Investments ($279 million) and Vocation ($253 million).

Read the original Deloitte media release here